5 hours agoTHE Employees Provident Fund EPF is set to release its performance for the first quarter ended March 31 2022 between now and mid-June. According to Section 43 1 of the EPF Act 1991 every employee and every employer must make monthly contributions to the EPF.

As an employer you are obligated to fulfil specific responsibilities including to register your organisation and employees with the EPF ensure orderly contributions and record keeping as well as comply with the existing.

. Gratuity payment to employee payable at the end of a service period or upon voluntary resignation Gifts includes Cash Payments for holidays like Hari Raya Christmas etc. Employers EPF contribution rate Employees EPF contribution rate Monthly salary rate RM5000 and below More than RM5000 RM5000 and below More than RM5000 Malaysian age 60 and above 4 0 Malaysian below age 60 13 12 9 Permanent resident below age 60 13 12 9 Permanent resident age 60 and above 65 6 55. Upon login click on Submit Contributions.

Employee contributes 0 of their monthly salary. Employers are only required to make a simple monthly contribution of RM5 regardless of your monthly salary. Even though a woman employee contributes 8 towards EPF the employer has to maintain its EPF contribution at 12.

12 for any wages more than RM5000. The first thing youll need to do is to download Form KWSP 16B and Form KWSP 3 and to fill in the relevant details. 9 of their monthly salary.

This is the Voluntary Provident Fund VPF. All payments must be made in the name of the EMPLOYEES PROVIDENT FUND. Contribution The EPF receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non-pensionable public sectors as well as voluntary contributions by those in the informal sector.

Contributions to your EPF are 3 percent from your employer. EPF Contribution Rates for Employees and Employers After the budget-2021 the EPF. Visit i-Akaun Majikan and enter your User ID then click Next.

How to contribute to the EPF for foreign employees. For Non-Malaysians registered as members from 1 August 1998 section B of EPF Contribution Table. Ensure that the Secret Phrase is correct before entering your password 3.

Last year and the fact that the statutory contribution rate for employees is set to normalise to 11 starting July this year 9 through June 2022 wagesJuly 2022 contribution. Payments Exempted From EPF Contribution. Employer contributes 12 of the employees salary.

EPF has their vision which is helping all Malaysias employees achieve a better future during retirement period and their mission is. However either you or your employer or both may contribute at a rate exceeding the statutory rates. If you opt to contribute to the EPF as a foreigner there is a caveat.

The amount of Rs. The contribution is calculated based on the monthly wages of an employee. As per year 2020 Malaysia EPF funding had reached RM998 billion making it the 4 th largest pension fund in Asia and 7 th largest in the world with the participation of over 7000000 employees and 500000 employers contribution.

When you contribute 11 of your monthly salary to the EPF your employer will contribute another 12 or 13 of your salary the statutory contribution rate is subject to changes by the government to your EPF savings. For Malaysians section E of EPF Contribution Table. Enter your PASSWORD and click Login.

12 contribution of monthly salary above RM5000 2. Update Maintain Records. Compliance Enforcement.

In Malaysia the. As for the amount that needs to be contributed this can be calculated based on the employees wages and the Third Schedule of the Act not by exact percentages unless monthly wages surpass RM20000. Employer 13 contribution of the monthly wages of RM 5000 and below.

For employee staffworkers is 11. A contribution of Rs 3000 12 of basic salary is due from employees to PF. For employer company 13 for any wages less than RM5000.

Employees aged 60 and above. What is the Mandatory Monthly Contribution of EPF KWSP. Employee 8 or 4 for employees above age 60 contribution of the monthly wages will be automatically deducted from the employees salary 1.

Well an employee can also add more than 12 towards EPF. Salaries Rs 25000 as a starting salary. What Is Employer Contribution In EPF.

A mandatory contribution constitutes the amount of money credited to members individual accounts in the EPF. It is important to note that EPF will continue to be active as long as you are a salaried employee. Now the next thing.

Ensure the correct Contribution Month before clicking Next. The payments below are not considered wages by the EPF and are not subject to EPF deduction.

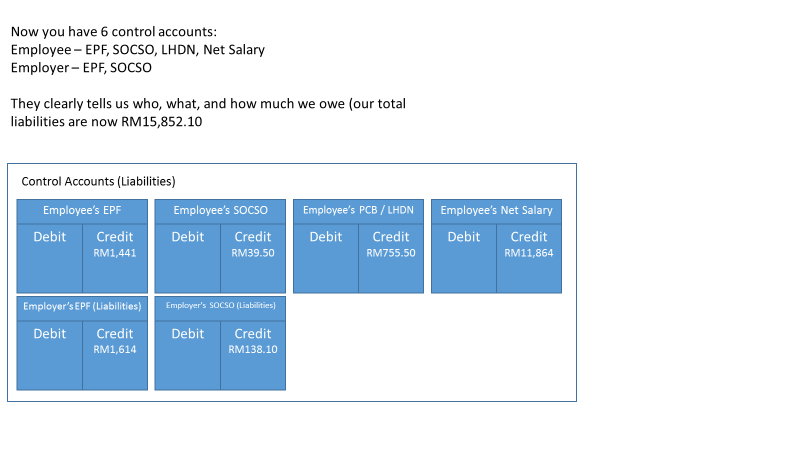

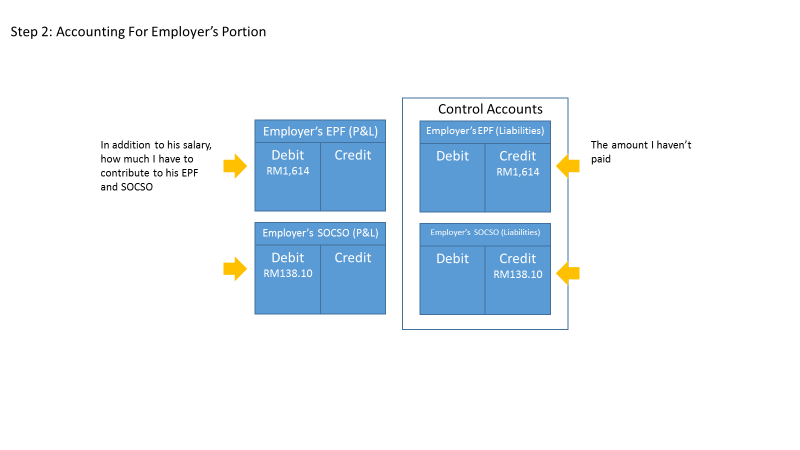

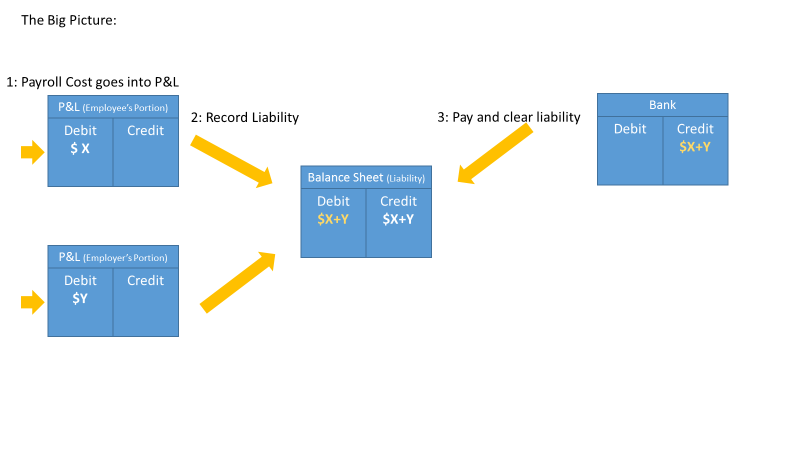

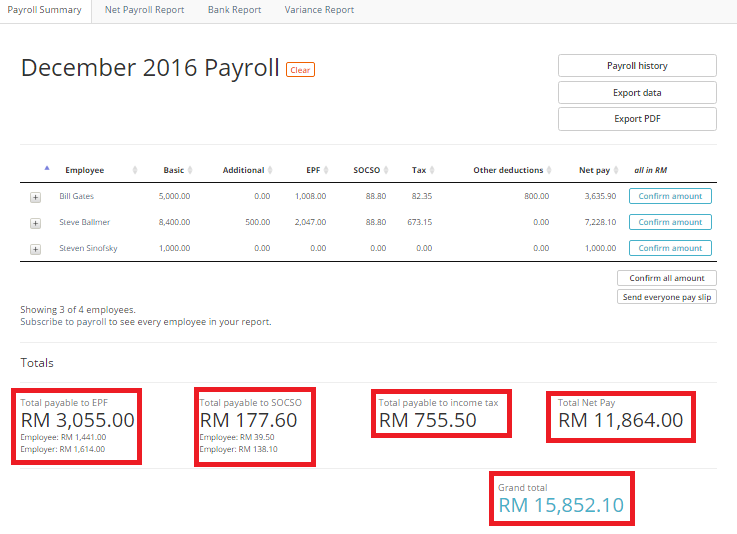

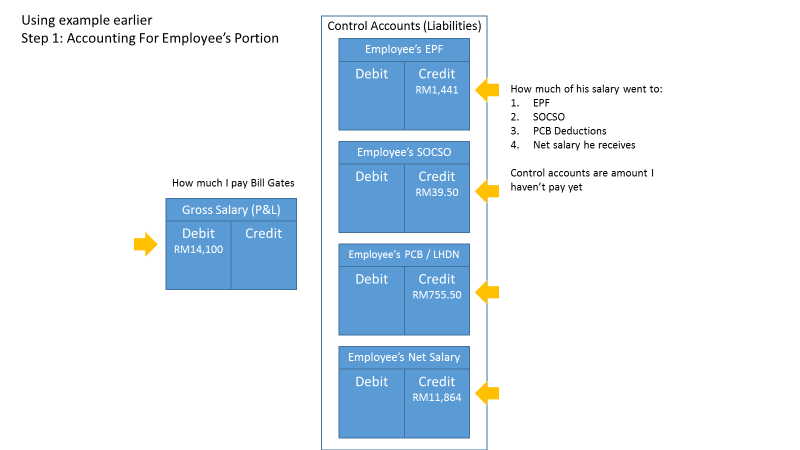

3 Steps To Get Payroll Data Into Your Accounting System

3 Steps To Get Payroll Data Into Your Accounting System

Assignment 1 Irl Thank You Analyze Issues Relating To The Provisions Of Law Which Compel Studocu

Kwsp All About Your Responsibility

维持epf 11 缴纳率申请步骤 L Co Accountants

3 Steps To Get Payroll Data Into Your Accounting System

3 Steps To Get Payroll Data Into Your Accounting System

15000 Salary After Tax Per Month Salary Information Websites

Epf Rate Epf 2021 Epf Contribution Rate Epf Calculator

Employee Epf Contribution Rate Sql Account Estream Hq Facebook

Foreign Worker Socso Eis Pcb Tax Epf Malaysia

3 Steps To Get Payroll Data Into Your Accounting System

What Payments Are Subject To Epf Donovan Ho

Epf Employees 2021 Statutory Contribution Rate Reduced To 9 From 11 The Edge Markets